MELBOURNE, Feb 19 (Reuters Breakingviews) – The recent nickel rout is exposing the paucity of smart long-term planning by Western miners and governments alike. That’s especially apparent in Australia, where Canberra and a state government are offering taxpayer incentives to try to help the industry. But it’s too little, too late.

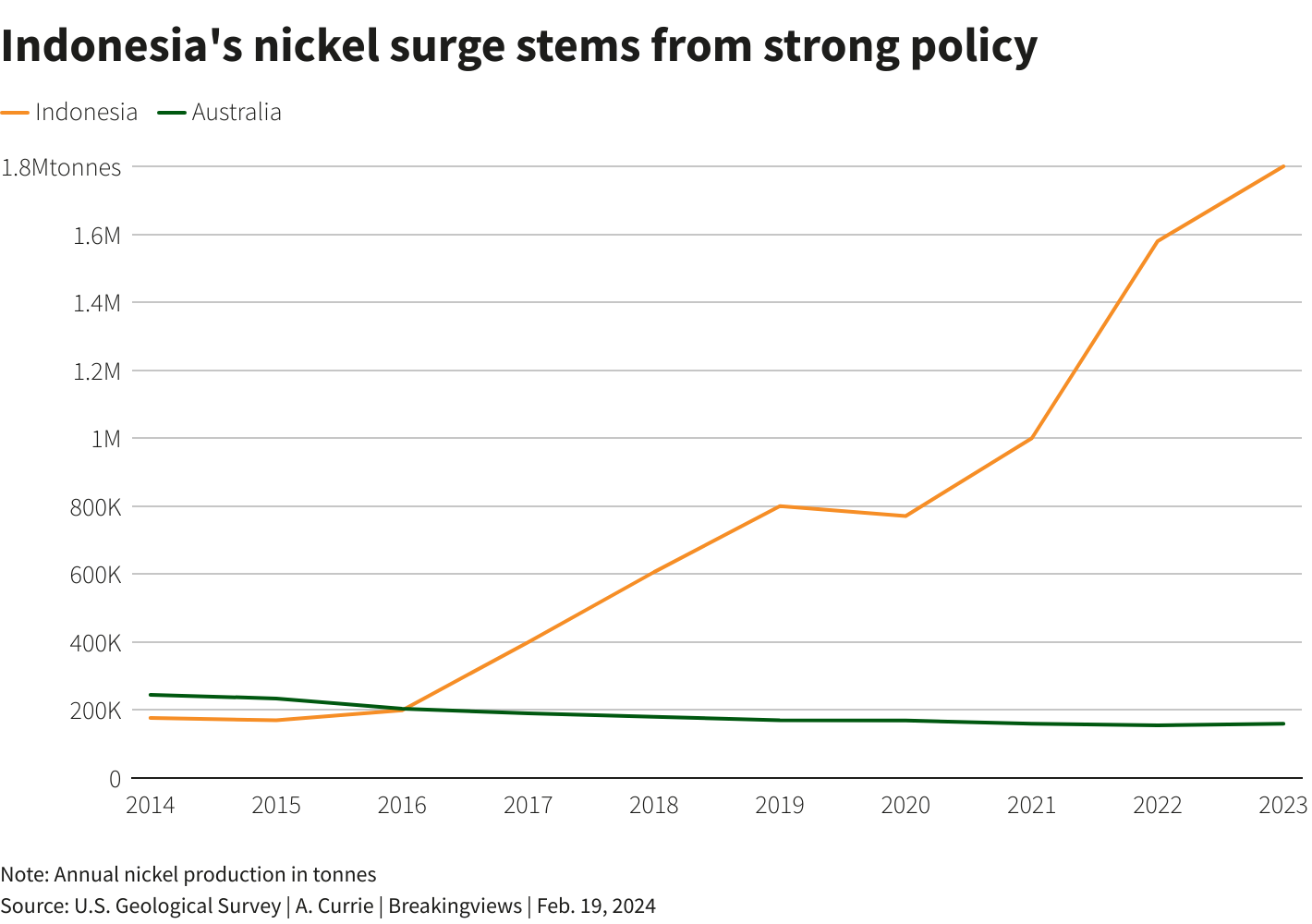

Granted, miners have not had it easy. The price of the silvery-white metal that goes into electric-vehicle batteries almost halved over the past year, in part due to nickel-heavyweight Indonesia using a new production process allowing it to increase supply.

Meanwhile, inflation, wage increases and other issues have pushed Australian miners’ production expenses, opens new tab up 49% since 2019 to some $17,000 a tonne, according to a report Mandala Partners prepared for The Chamber of Minerals and Energy of Western Australia. That’s more than $700 a tonne above where the metal currently trades and 28% higher than costs at the Morowali mine in Indonesia owned by China’s Tsingshan Holding, the consulting firm reckons.

A flurry of aid won’t do much to close the gap. Western Australia, for example, on Saturday said it would halve, opens new tab the 2.5% royalty it collects whenever the average price in a quarter is below $20,000 a tonne. At the current level, that would save miners just $200 a tonne. And they would eventually have to pay it back over 24 months.

The federal government on Friday added nickel to its critical minerals list, which gives the industry access to an A$4 billion ($2.62 billion) pool of funding and grants. Along with a production tax credit under consideration, that could make companies like Andrew Forrest-backed Wyloo, IGO (IGO.AX), opens new tab and First Quantum (FM.TO), opens new tab consider at some point building facilities to process more of the metal onshore, and thus capture more of the economics. But it’s unlikely to prompt them or their competitors to reverse decisions in recent months to mothball projects.

Ultimately, there was little official planning for investment or for volatility when the price was far higher. Successive governments missed a trick to act earlier. Only Indonesia has more nickel reserves than Australia, yet the latter’s production has dropped 35% in the decade since Jakarta first floated plans to develop its domestic industry. The archipelago’s output has since jumped tenfold. It’s a reminder not leave strategy too much at the mercy of the market.

Source: REUTERS