TOKYO, March 11 (Reuters) – Resource-scarce Japan is shoring up long-term supplies of liquefied natural gas from close allies Australia and the United States as key contracts from providers including Russia are set to expire by the early 2030s.

LNG accounts for about a third of Japan’s power generation and it is the world’s second-largest importer behind China.

It remains a key part of Japan’s energy mix even though imports fell by 8% last year to the lowest since 2009 as it has increased the use of renewable energy and restarted some nuclear reactors following a complete shutdown after the Fukushima disaster in 2011.

Since 2022, Japanese LNG buyers have struck equity deals in five projects in Australia and the U.S. including an exploration block. They have secured 10- to 20-year offtake contracts from those countries for more than 5 million metric tons annually, or 8% of Japan’s 2023 consumption, according to a Reuters calculation, eclipsing transactions elsewhere in the world.

Political issues including new carbon emissions rules in the Australia introduced in mid-2023 and President Joe Biden’s freeze in January on new U.S. LNG export licence approvals have not dented Japan’s appetite for long-term supplies from those countries.

Kyushu Electric Power (9508.T), opens new tab, among the top five Japanese utilities, has said it is considering buying a stake in Energy Transfer’s (ET.N), opens new tab Lake Charles LNG project in the United States, even though it is now subject to the U.S. licence freeze.

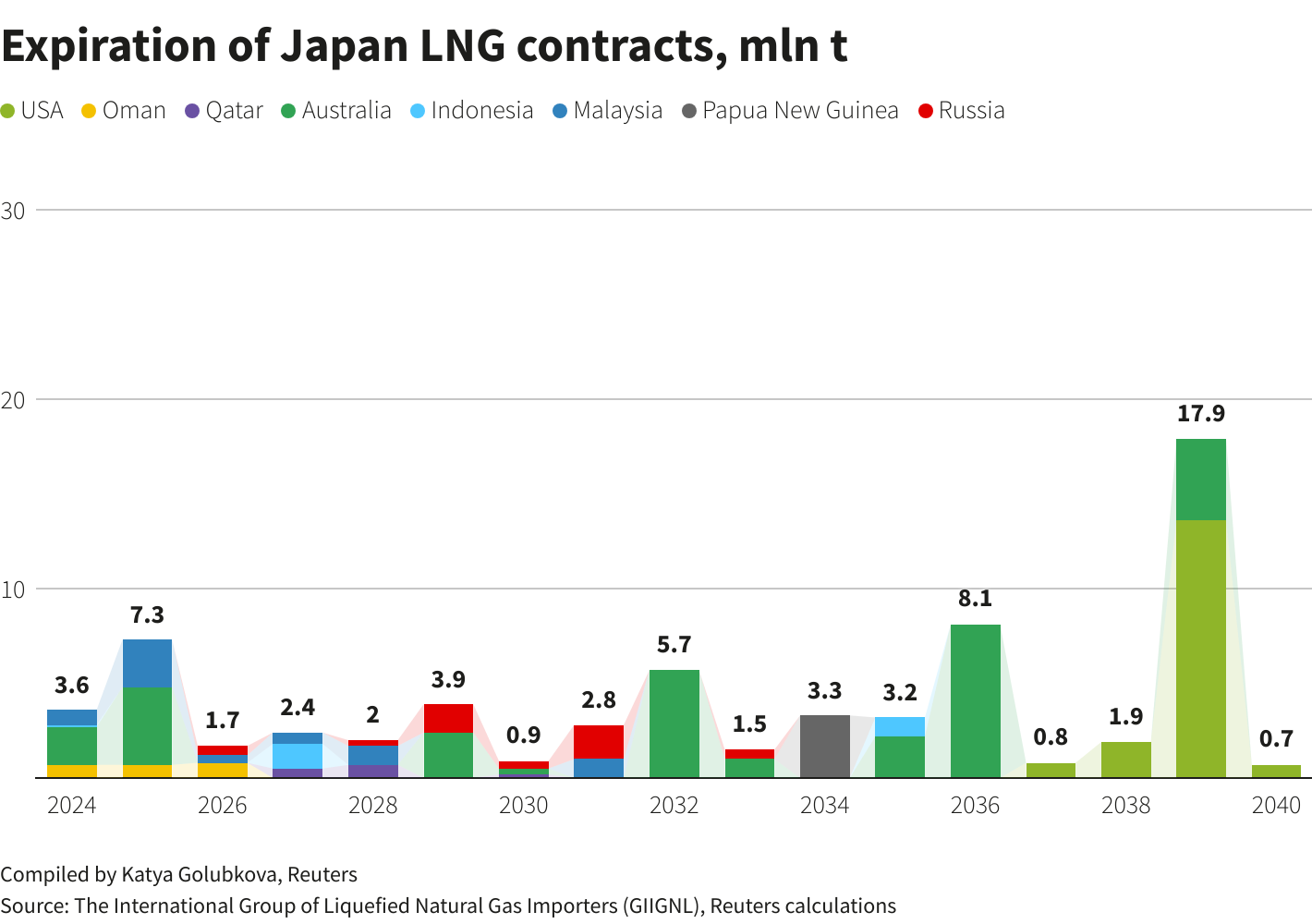

Kyushu Electric has long-term supply contracts with Australia, Indonesia and Russia, some of which are due to expire between 2027 and 2032.

Mitsuyoshi said Indonesia may have limited export capacity in the future due to strong domestic demand thanks to a growing economy.

Qatar, another Japan supplier, is ramping up production but some buyers chafe at its contracts that limit flexibility to trade cargoes, with Japan’s industry minister last year calling for the elimination of the destination clause.

Since 2022, Japanese LNG buyers have increased their involvement with Oman, but on a smaller scale compared to Australia and the U.S., while Inpex (1605.T), opens new tab acquired new exploration licences in Malaysia.

REPLACING RUSSIA

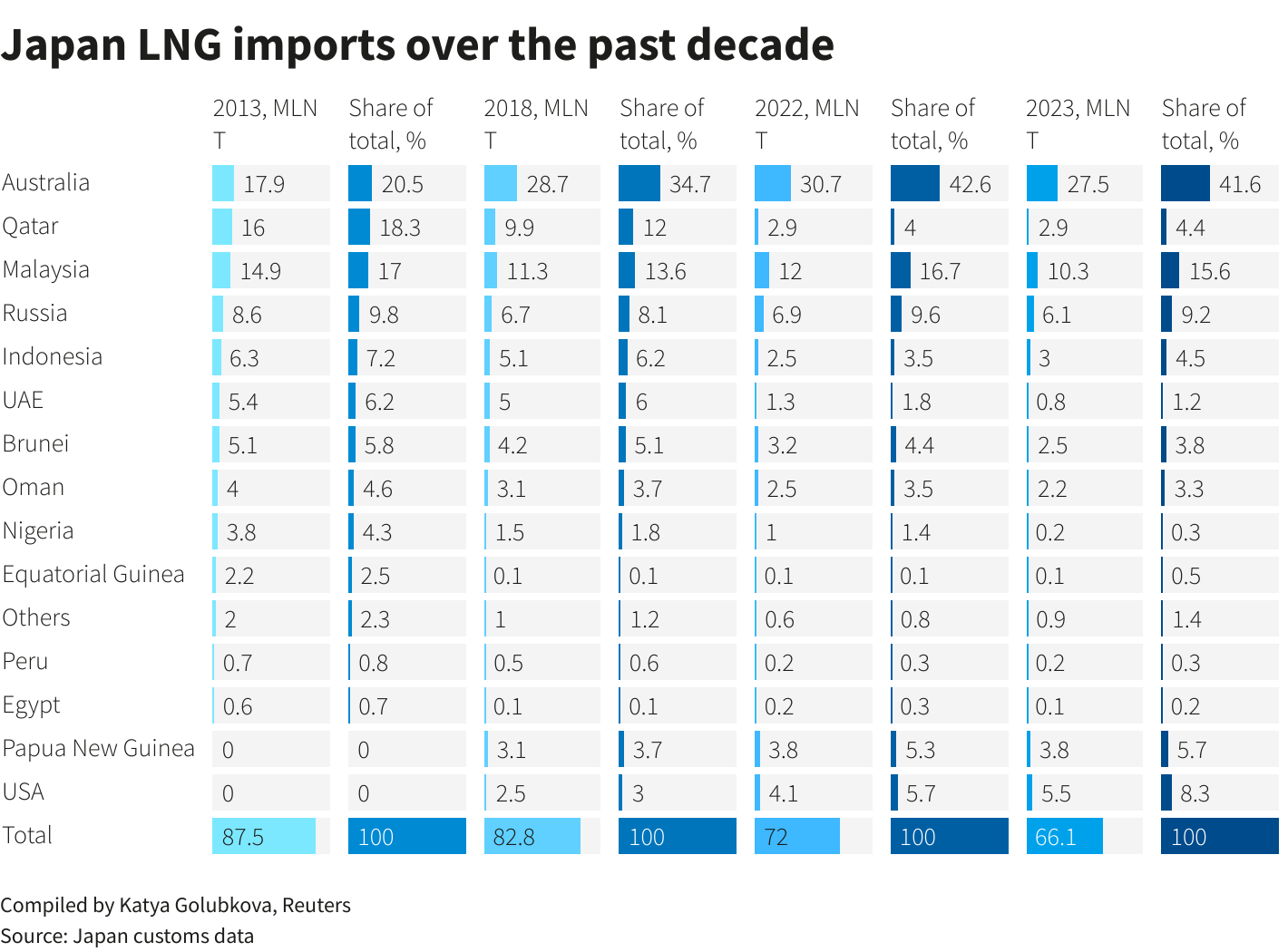

LNG flows to Japan have changed over the last decade, including large declines from Indonesia, Malaysia, Qatar and Russia as well as the U.S. and Papua New Guinea becoming major new suppliers, according to Japan customs data.

Throughout that period, Australia has been its top supplier, though other new sources are emerging.

Canada, a G7 member, is preparing to start its first major export facility, from which Mitsubishi Corp (8058.T), opens new tab, a shareholder, will receive over 2 million tons of LNG annually.

Yoko Nobuoka, senior analyst for Japan power research at LSEG, said the importance of cooperation with allies for Japan’s energy security, including LNG, had increased on the back of the energy crisis triggered by Russia’s invasion of Ukraine.

Russia was Japan’s third-biggest LNG supplier last year, after Australia and Malaysia, but imports fell 10.7% from 2022.

Much of Japan’s Russian LNG comes from the Sakhalin-2 project, but many of its long-term contracts are set to lapse around 2030, giving added incentive to lock in deals elsewhere.

The vast new Arctic LNG 2 project, in which Mitsui & Co (8031.T), opens new tab and state-owned Japan Organization for Metals and Energy Security (JOGMEC) together own 10%, underscores the perils of Tokyo’s reliance on Russian gas.

Washington in November imposed sanctions on the project, prompting its operator, Novatek, to declare force majeure and leading Mitsui to record an additional provision of 13.6 billion yen ($91.94 million).

“But G7 members can’t cut that reliance (on Russian LNG) overnight, so that’s why they need boosted LNG supplies from allies,” said David Boling, a director at consulting firm Eurasia Group who was deputy assistant U.S. trade representative for Japan from 2015 to 2022.

($1 = 147.9300 yen)

Source: REUTERS